Insurance and Restoration

For insurance carriers, claims adjusters, restoration companies, or property owners, Matterport ensures the delivery of accurate, transparent, and fair documentation and valuations. Our services can help you save time, cut costs, and expedite the claims process.

3D Matterport for Insurance & Restoration

Matterport’s 3D virtual tours and digital twin creation offer a range of clear advantages when working on insurance claims handling and restoration projects. The traditional process of manually documenting property losses, collecting exhaustive evidence, and processing claims is inherently time-consuming. Multiple site visits for capturing photos and measurements impede forensics engineering operations. Matterport’s 3D tour technology eliminates these bottlenecks. By creating immersive, accurate ‘digital twins’ of properties, insurers can remotely assess damage, accelerating claims processing. Restoration experts benefit from detailed virtual replicas, enabling more efficient planning and execution. Ultimately, Matterport’s hardware and software enhances efficiency, reduces costs, and expedites both insurance claims and restoration projects, transforming the industry.

More 3D Virtual Tour options…

We’re in your backyard!

We operate nationwide across Australia with the biggest network of operators in the country.

Just give us a call on 1300 00 3392 or contact us here for an instant quote and to get booked in.

3D VIRTUAL TOURS < 500 SQM $500 NATIONWIDE

BOOK NOWBenefits of using 3D virtual tours for insurance & restoration projects

Time Savings: Eliminates the need for time-consuming manual property documentation.

Efficient Evidence Collection: Streamlines the process of gathering thorough evidence.

Remote Assessment: Allows insurers to assess damage remotely, reducing the need for site visits.

Accelerated Claims Processing: Speeds up the entire claims handling process.

Reduced Site Visits: Minimizes the necessity for repeated on-site measurements and photos.

Enhanced Accuracy: Provides precise, immersive digital replicas of properties.

Improved Collaboration: Facilitates collaboration among teams working on restoration projects.

Cost Reduction: Decreases expenses associated with site visits and manual documentation.

Comprehensive Planning: Offers restoration experts detailed virtual models for better project planning.

Industry Transformation: Revolutionizes insurance claims and restoration practices, increasing efficiency and productivity.

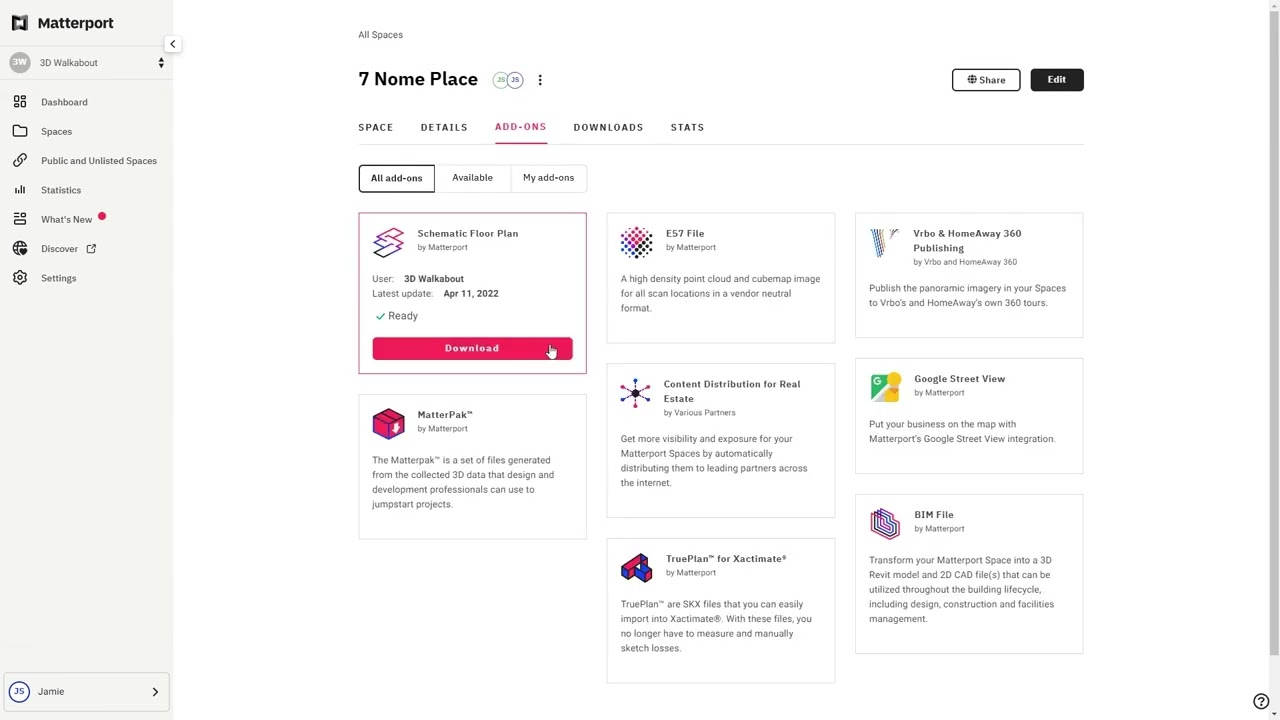

A Powerful Suite of Features

Transform how you market and manage your properties with Matterport’s twin digital platform.

How Matterport 3D tours can help improve insurance and restoration projects

Matterport’s 3D virtual tours and digital twin creation introduce a wave of clear advantages that significantly improve efficiency and effectiveness across the board.

In the traditional process, documenting property losses, collecting comprehensive evidence, and processing claims are inherently time-consuming tasks. One of the major bottlenecks is the need for multiple site visits to capture hundreds of photos and measurements manually. This not only consumes valuable time but also hampers the fluidity of forensics engineering operations.

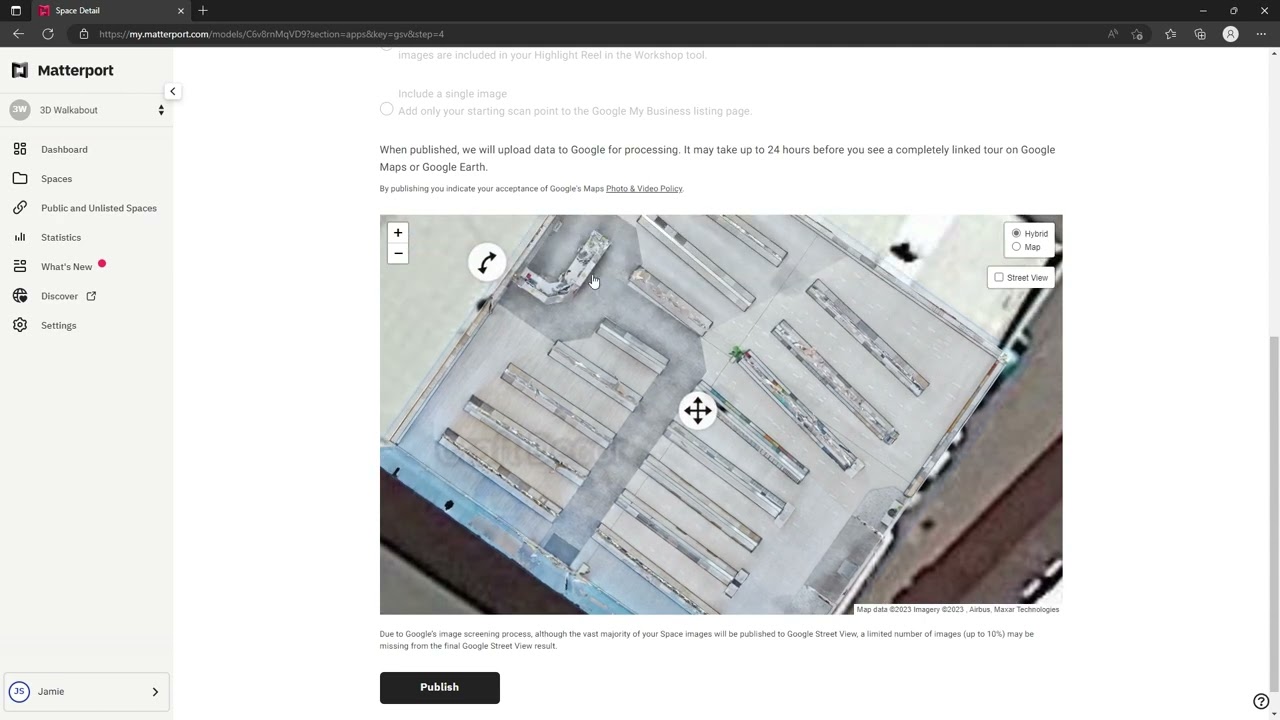

Matterport’s innovative technology swiftly addresses these challenges. It allows for the creation of immersive and highly accurate digital twins of properties. With these digital replicas in hand, insurers gain the ability to remotely assess damage, eliminating the necessity for frequent and often time-consuming site visits. This alone accelerates the claims processing timeline considerably.

But the benefits don’t stop there. Restoration experts also reap rewards from Matterport’s digital twins. These detailed virtual models provide an invaluable resource for more efficient planning and execution of restoration projects. The ability to explore a property virtually, with precise measurements and visuals, streamlines decision-making and enhances project outcomes.

Matterport’s innovation is a transformative force within the insurance and restoration industries. It not only enhances efficiency but also reduces costs and expedites the entire process. With the power of digital twins, Matterport is reshaping the way insurance claims are handled and restoration projects are executed, ushering in a new era of productivity and effectiveness.

Extensive Guidance for Insurance and Restoration Experts

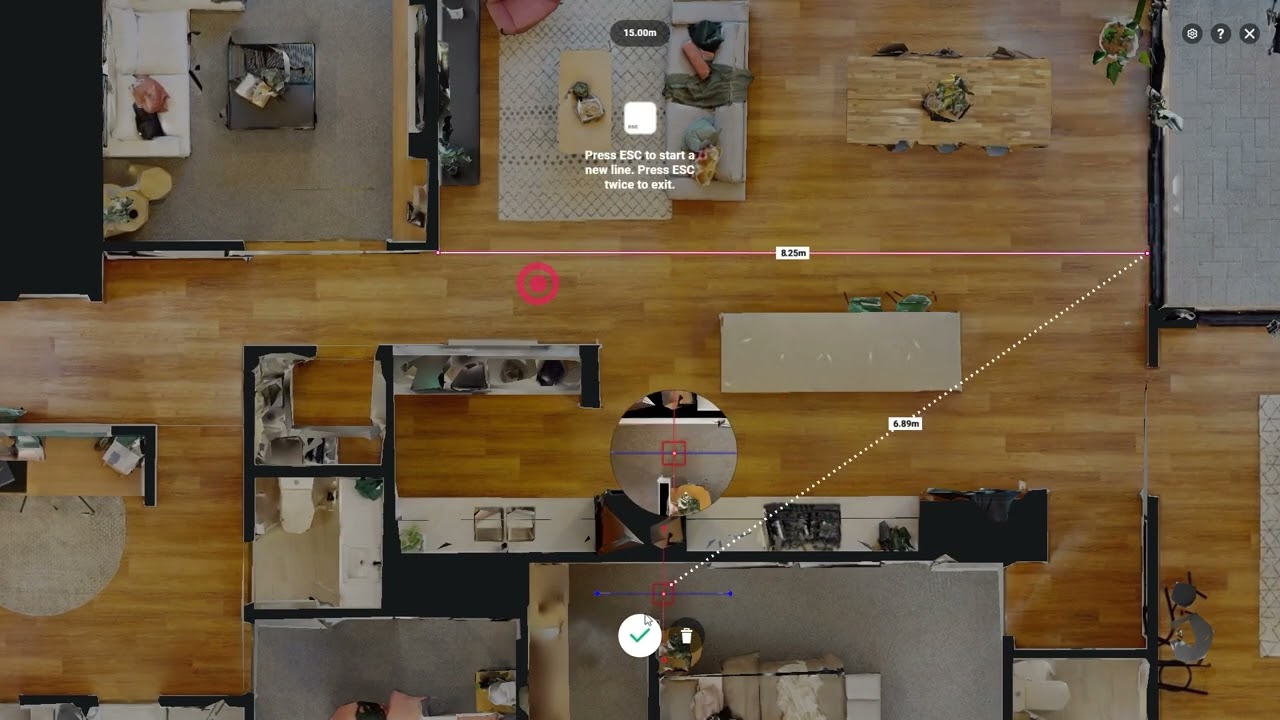

Eliminate the requirement for excessive photos, measurements, multiple site visits, and written accounts, thanks to the inclusion of 3D walkthroughs. Achieve a comprehensive record of loss that is beyond dispute. Enhance your top-line earnings by delivering the most precise documentation available. Expedite claim approvals and streamline case closures through meticulous documentation. Reduce the occurrence of policyholder disputes with a pre-mitigation scan that captures the present condition comprehensively.

Precise, Easily Updated Documentation Throughout the Insurance Process

Ensure your insurance coverage benefits from the most comprehensive pre-loss asset documentation and risk management, facilitated by a digital twin that enhances underwriting practices with greater insight and accuracy. Minimize the initial insurance risk associated with a building, eliminating the necessity for physical re-inspections. Achieve unbeatable documentation precision, enabling superior assessments compared to outsourced inspections. Incorporate policy and claims notes directly into the 3D model for enhanced record-keeping.

Legally Recognized Insurance Adjuster Documentation for Time Efficiency

Matterport’s 3D data platform produces walkthroughs, schematic floor plans, and additional resources to streamline your workflow and guarantee equitable settlements. Generate legally admissible documentation with unalterable spaces. Manage adjustments remotely, cutting down on travel time to site locations. Slash sketching time by as much as 70%. Transport the jury to the scene using immersive 3D walkthroughs. Enhance client negotiations with the utmost precision in documentation and comprehensive background information.

Unparalleled Precision in Insurance Carrier Documentation

Enhancing the comprehensiveness of record-keeping during claims processing minimizes discrepancies and expedites issue resolution. Enhanced accuracy shortens the claims processing timeline, providing policyholders with a superior customer experience. Enhance operational transparency by sharing links to 3D spaces with various stakeholders. Elevate adjuster efficiency and precision in remotely reviewing and navigating losses with precise property measurements. Enhance responsiveness during catastrophic events (CAT) when in-house field adjustment teams are stretched thin.

Comprehensive and Immersive Documentation for Forensics Experts

Precisely capture a building or space in its unaltered state, obtaining the most precise documentation and measurements available. Matterport empowers you to present irrefutable evidence while minimizing disruptions to restoration efforts. Establish legally valid documentation with tamper-proof scans. Preserve the scene and prevent contamination. Transport the jury to the location using immersive 3D walkthroughs. Ensure confidentiality and authenticity through face blurring and time stamps. Enhance efficiency and precision with schematic floor plans and measurement tools, ultimately saving time.

Precise Claims Documentation for Home and Business Proprietors

Property owners can utilize Matterport’s lifelike and all-encompassing platform to document residences, businesses, or assets, streamlining the claims process. Attain a thorough record of your property’s current condition. Accurately catalog personal belongings and assets within your property. Minimize disparities and disagreements with insurance providers. Accelerate the entire claims procedure, occasionally obviating the requirement for document submission or receipts.

Get an Instant Quote on 1300 00 3392

If you’d like to receive our full ‘3D Virtual Matterport Tours Information Pack & Price List‘ add your details below.

3D Scanning Case Studies

No Results Found

The page you requested could not be found. Try refining your search, or use the navigation above to locate the post.

Frequently Asked Questions

Is Matterport technology adaptable to various property types, including residential and commercial?

Yes, Matterport technology is versatile and can be applied to residential, commercial, industrial, and even cultural heritage properties, making it a valuable tool for a broad range of applications in the insurance and restoration industries.

Can Matterport be used for historical documentation of properties for insurance purposes?

Absolutely, Matterport’s 3D scans serve as a valuable historical record, aiding in future assessments and claims.

What cost-saving benefits does Matterport offer for insurers and restoration companies?

Matterport technology reduces the costs associated with physical site visits, manual documentation, and rework, leading to significant savings.

Does Matterport technology assist in collaboration among restoration teams?

Absolutely, Matterport’s digital twins enhance collaboration by allowing all team members to view and interact with the same 3D model, regardless of their location.

How can Matterport be used for restoration projects?

Restoration experts can use Matterport’s digital twins for project planning, as these detailed virtual replicas provide comprehensive information about the property’s condition.

Can Matterport's technology improve accuracy in property damage assessment?

Yes, Matterport’s technology offers precise measurements and visuals, reducing errors and ensuring more accurate damage assessments.

What advantages does digital twin technology offer in insurance assessment?

Digital twins provide insurers with highly accurate, interactive 3D models of properties, facilitating in-depth assessment and more informed decision-making.

How can Matterport 3D technology expedite the insurance claims process?

Matterport’s digital twins enable remote assessment of properties, reducing the need for physical site visits. This accelerates the claims handling process by providing insurers with comprehensive, real-time data.